If you are currently following a ketogenic diet, also called keto, then you have probably…

With a Disrupted Coffee Value Chain, Collaboration is Needed to Help Save Specialty

Luiz Roberto Saldanha Rodrigues reviews Capricornio Coffee’s COVID-19 response and procedures for farm workers. Image courtesy of Fazenda California.

As the initial panic over COVID-19 begins to subside and coffee companies begin to look beyond their immediate, short-term concerns, specialty coffee sellers and buyers are beginning to take a deeper look at the disruptions that various value chain partners are experiencing, and what the medium-term effects might be.

Leveraging our work with data donors to the Specialty Coffee Transaction Guide, we brought together a group of progressive coffee industry representatives to talk about harvest, the movement of coffee, preexisting inventory, and expected impacts on supply chain relationships in the coming weeks, months and years.

Uncertainties Complicate Coffee Production and Exports

Our conversation started on the farm. In Brazil, where harvest is just beginning, worries about health and safety, labor costs, and market liquidity were all on the top of the mind of Luiz Roberto Saldanha Rodrigues of Capricornio Coffees, a Brazilian exporting company.

Farmers in Brazil, faced with ambiguities about whether they will have a market for quality coffees, are thinking through the value proposition of whether investing in expensive quality-yielding production and preparation practices will be worth it.

Pickers don protective masks at Luiz Roberto Saldanha Rodrigues’ farm in Brazil prepared for harvest during the COVID-19 pandemic. Image courtesy of Fazenda California.

“If we don’t have the buyers, we could have a problem of having a huge crop, higher prices for labor in order to make this harvest, and then we can have a crisis on pricing … [bringing] huge uncertainty in terms of how we should manage this crop,” Luiz said.

Elsewhere in the coffee-producing world, exporters like Christian Safie with Unitrade Coffee Trading Company in Guatemala are seeing some producers still in the midst of harvest leaving coffees on the trees without known buyers. Beyond the lost income for this season, this abandonment of cherries can lead to future challenges, like broca borer.

Christian is seeing an uptick in delayed and cancelled contracts, which will ultimately push losses back to producers who “are not only losing the coffee that they worked so hard to grow because it’s falling off the tree, but they’re not able to get an income for whatever they already harvested.”

Christian Safie documents limited staffing at Unitrade Coffee and required protective gear. Courtesy image.

Nick Kirby from Enveritas, a nonprofit focused on data-driven solutions for long-standing obstacles to sustainability in specialty coffee, echoed these concerns. Enveritas recently surveyed producers in their networks to begin understanding the effects of COVID-19.

Nick highlighted that “the overarching concern [is about whether or not] buyers are still there” and whether farmers’ sunk investments in lot separation and quality-oriented processing will yield any return at all.

Christian also spoke of the increased risk exporters are assuming to avoid further delays amidst the quarantine. Once specialty coffee finally makes its way through congested milling processes, transportation restrictions and port delays are causing hold ups.

“There are containers waiting at port, just sitting there and baking … maybe it will affect quality [but] then we don’t know [to] what extent,” Christian said, adding that at Unitrade, “we’ve seen some roasters that are just waving off receiving pre-shipment samples and just telling us to ship the coffee, as soon as possible.”

We hope that decisions like this to speed the shipment process do not lead to the unnerving expectation that the exporter assumes the risk of any quality-based rejections from importers and roasters upon arrival.

Navigating Changing Demand and Business Channels

Demand uncertainty is also overwhelming in consuming markets such as the United States. Jessica Brooks of Allegro Coffee and Geoff Watts of Intelligentsia Coffee joined the conversation to help us understand how roasters have been innovating to keep up with shifting consumer demands while trying to keep their most trusted relationships strong.

Reflecting on Christian’s comments about shipment quality concerns, Jessica described a new orientation related to how her team approaches coffee quality. Rather than quibbling over the value of half a point on a pre-shipment sample to make sure it exactly matches the specifications for its intended use, the roasting team at Allegro Coffee has chosen to think creatively when allocating preexisting contracts and inventory. These efforts mean they can honor forward commitments critical to their supply partners.

Said Jessica, “I think there’s a definite need for collaboration and an openness between buyers and our suppliers.”

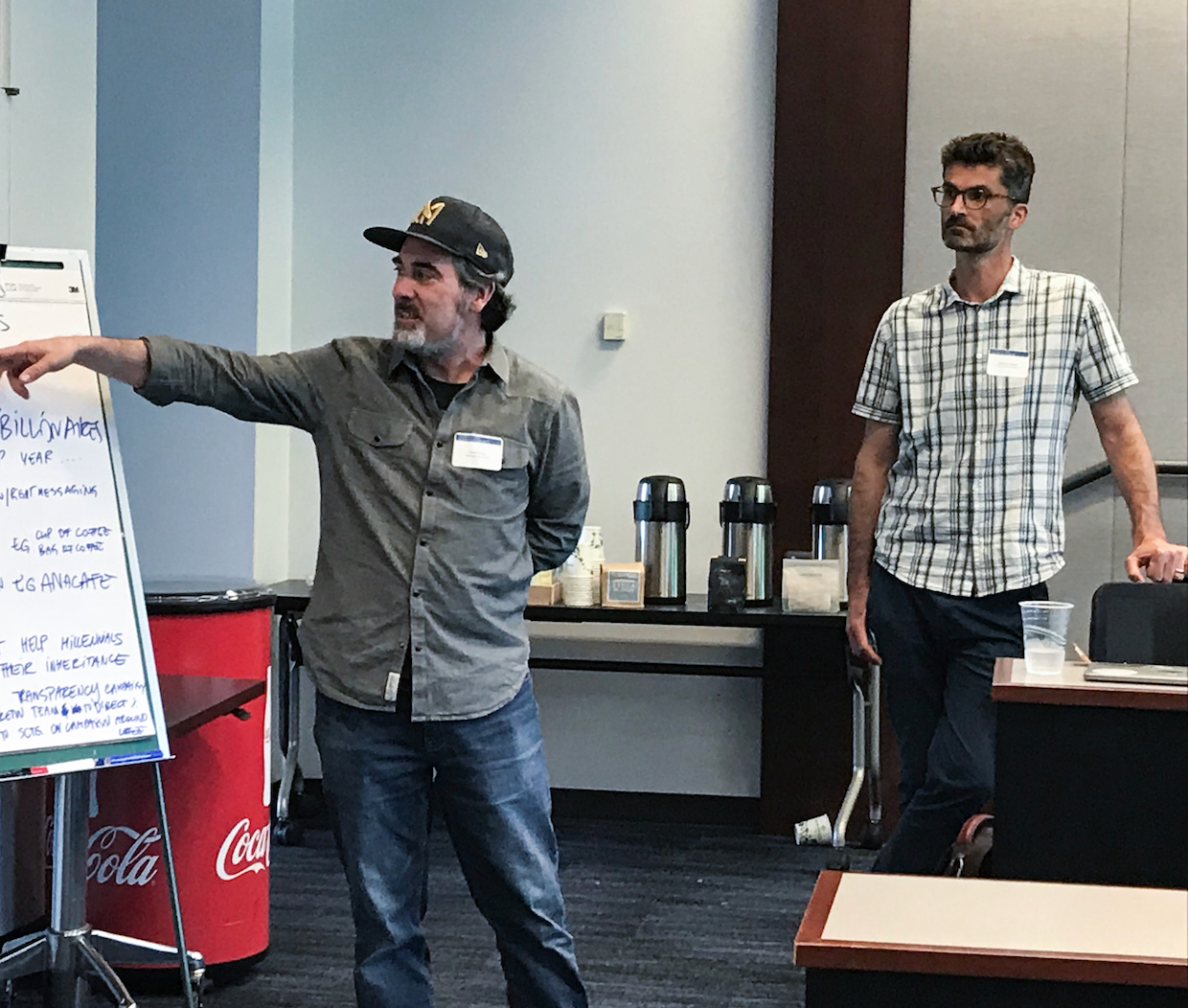

Geoff echoed the sentiments of increased flexibility in the allocation of coffees, noting that online sales at Intelligentsia have been up as people have been drinking more coffee from home.

He encourages roasters to use this time of rapid change to “contemplate and examine with new eyes what it is we do and figure out how to do it better.” When Geoff says “better,” he is looking for ways where we all consistently win as participants in the specialty coffee value chain.

Collaboration and Transparency Throughout the Value Chain

Ever Meister from Cafe Imports explained that challenging herself and her peers to consider the myriad disruptions faced by colleagues throughout the supply chain can be exceptionally difficult, but it is also a necessary exercise in order to adapt and move forward.

“Now is the time to put competition aside and really evaluate our expectations for the way that we want the specialty coffee industry in particular to operate,” Meister said, while advocating for stronger supplier-buyer relationships moving forward.

“I know buyers are scared,” said Luiz, but “we [exporters] are also scared; farmers are scared.”

Mutual empathy will lead to a better collective understanding of the best paths forward. Throughout our call, there was a shared sentiment, stressed by Luiz and Christian, to stand with buyers and clients and to develop solutions collectively to achieve a common goal of resiliency. This is one of the ways in which these challenging weeks and months ahead might produce lasting improvements in specialty coffee supply chains.

Geoff Watts of Intelligentsia Coffee (left) at the 2019 Specialty Coffee Transparency Colloquium at Emory University last year, prior to the COVID-19 outbreak. Image courtesy of Emory University.

Said Geoff, “Out of crisis often comes some of the best innovation, the most creative thinking, the most willingness… to have to think your way out of it.”

Rather than the forecasting rigidity and zero-risk-tolerance typically held tight by roasting companies, our progressive peers aligned on a desire for flexibility, empathy, and transparency to cultivate collective paths forward along which risks and rewards are more evenly shared.

In this spirit, our export and import peers, Christian and Meister, are encouraging conversations with clients that prioritize honoring contracts and sharing risk in the movement of coffee during this uncertain time.

Meanwhile, Jessica and Geoff, on the roasting side, are encouraging roasters to be creative with the tools that all roasters have, including the skill to blend coffees and the ability to shape consumer expectations. This kind of creativity will help to accommodate shifting consumer demands in ways that benefit the entire value chain.

Hope for an Evolving Industry of Shared Responsibility

While realizing that we are all scared and are all facing immense challenges, parts of our conversation felt like this pandemic might also be a call to action. With the right collective mindset, the COVID-19 crisis could galvanize a market that too often struggles to honestly address the many inequities within it.

Our collective fear and anxiety can inspire collaboration, lead to dignified and mutually beneficial importance of partners in the value chain and, most of all, deepen empathy and understanding for the difficulties we all face in our businesses, even in the best of times.

Our network at the Specialty Coffee Transaction Guide is made up of progressive and innovative coffee industry stakeholders who embrace and welcome greater transparency and honesty in the value chain to strengthen it. Their leadership and willingness to share their own fears and talk about the challenges they face at this time is inspiring and we hope others feel motivated to have critical and challenging conversations in their own supply chains.

In order to emerge from this intact, we will need to keep talking to one another about our experiences and challenges and even fears. We encourage you to do so within your own networks and to reach out to others with empathy and a collaborative spirit as we work together to come out of this crisis a stronger, more equitable specialty coffee industry.

If you would like to watch our recorded conversation with Christian, Geoff, Jess, Luiz, Meister and Nick, please click here.

Related Reading

Chad Trewick and Aelish Brown

Chad Trewick has worked for more than 25 years in specialty coffee and now leads Reciprocafé LLC, a consultancy prioritizing mutual benefit throughout the coffee industry. Aelish is a Social Enterprise @ Goizueta Program Associate at Emory University’s Goizueta Business School, where she supports the Specialty Coffee Transaction Guide and Grounds for Empowerment programs.